Aragon DAO Tool Report For 2025

What Is Aragon

Aragon operates as an open-source platform built on the Ethereum blockchain. The system allows users to create and manage decentralized autonomous organizations without technical expertise. Founded in 2016 by Luis Cuende and Jorge Izquierdo, Aragon became the first DAO framework in the blockchain space.

The platform enables communities to control assets worth billions of dollars. Leading projects including Lido, Decentraland, API3, and NFTX rely on Aragon's infrastructure. Over 7,000 DAOs have launched using Aragon's technology across Ethereum Layer 1 and Layer 2 networks.

Aragon provides three core products: a no-code app launcher, the modular OSx protocol, and custom build services. Users can deploy a complete DAO in under 10 minutes. The Aragon Network Token (ANT) serves as the governance mechanism, with current circulation at 43.19 million tokens.

Aragon OSx Architecture

OSx represents Aragon's modular framework launched in March 2023. The architecture separates core functionality from plugins, improving security and customization. Each DAO consists of three interconnected components: the main contract, permission management, and plugin system.

The DAO contract holds organizational assets and manages identity through ENS names. Permission controls define which addresses execute specific functions within the organization. Plugins contain custom logic and can be installed or removed through governance proposals.

Security audits happen regularly. Halborn completed the most recent audit from November 2024 through February 2025. Code4rena conducted a community review in March 2023, identifying four medium-severity issues that were resolved.

Aragon Adoption Across Networks 2023-2025

Data: Aragon Blog, GitHub activity metrics, industry reports

Aragon expanded to nine blockchains by October 2025. The platform now operates on Ethereum, Polygon, Arbitrum, Optimism, Base, Celo, Peaq, zkSync, and Gnosis Chain. This multichain presence reduces gas costs by up to 90% on Layer 2 networks.

Transaction costs on Arbitrum average just cents compared to dollars on Ethereum mainnet. Celo integration in May 2025 brought mobile-first DeFi access to emerging markets. The Peaq deployment targets the Machine Economy and DePIN ecosystems.

Major 2025 Updates

EVM Address Integration

May 2025 brought the ability to use any EVM-compatible address as a governing body. Organizations can now plug in Safe multisigs, OpenZeppelin contracts, or external DAOs directly into the Aragon App interface.

Previous versions limited governing bodies to OSx plugins only. This update enables more granular security setups and improves interoperability with the wider ecosystem. Veto rights and proposal approvals can be assigned across different platforms.

Governance Designer

The Governance Designer supports two design flows as of 2025. Existing governance processes can now create entirely new ones without redeployment. Organizations evolve their structures as they grow without technical overhead.

Custom headers on dashboards now reflect organizational branding. Full theming support will roll out later in 2025. Organizations wanting completely custom UIs can access Aragon's Custom Build services.

Value Accrual Toolkit

Aragon launched veLocker and Gauge primitives in March 2025. These tools optimize resource allocation through incentive alignment. The toolkit helps projects direct capital toward community-valued initiatives.

Celo Public Goods Gauges serve as the first major implementation. YieldBasis, created by the team behind Curve, builds on these foundations. The system connects governance, incentives, and value accrual for long-term sustainability.

Token Import Feature

Creating new governance processes no longer requires deploying new tokens. Organizations can import existing governance tokens directly into the app. This streamlines setup for projects with established token economies.

Aragon Versus Competitor Platforms

| Platform | Type | Gas Costs | Setup Time | Key Strength |

|---|---|---|---|---|

| Aragon OSx | On-chain | Medium (cents on L2) | Under 10 min | Modular plugins and security |

| Snapshot | Off-chain | None (gasless) | 5 min | Zero-cost voting and flexibility |

| Tally | On-chain | Low to medium | 15 min | Transparency and analytics |

| DAOhaus | On-chain | Low | 10 min | Community focus and simplicity |

| Colony | On-chain | Medium | 20 min | Reputation-based governance |

| XDAO | Hybrid | Low | 8 min | Cross-chain deployment speed |

Data: DAO governance platform documentation, user testing results, Alchemy research

Aragon Market Position 2025

Data: DeFi analytics platforms, DAO tooling usage reports, industry surveys

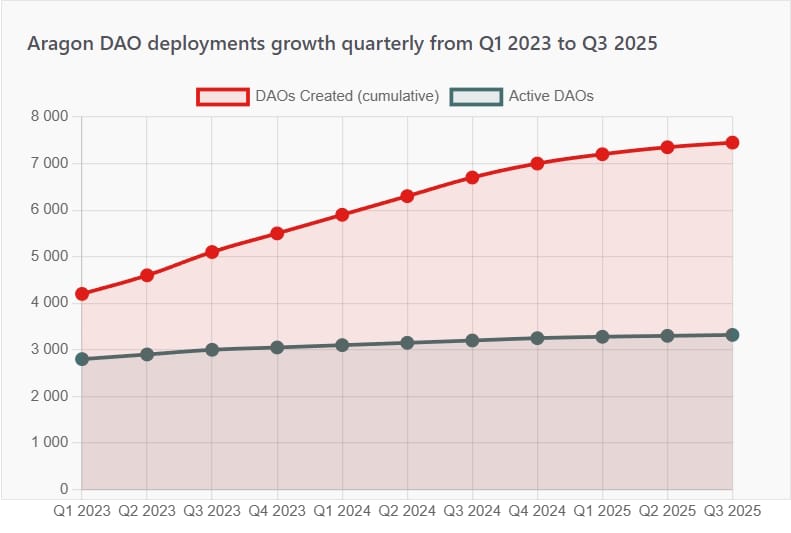

Aragon maintains a strong position among DAO frameworks. The platform supports over 3,000 active DAOs according to 2025 statistics. Tally leads in sheer numbers with 10x more on-chain DAOs. Snapshot dominates off-chain signaling with the most integrations.

Aragon differentiates through security and modularity. The OSx framework received praise from developers for its plugin architecture. Organizations managing substantial treasuries prefer Aragon's audited smart contracts and permission granularity.

Use Cases and Applications

Protocol governance represents Aragon's primary use case. Lido uses Aragon to manage staking operations worth billions of dollars. The setup provides secure voting mechanisms for protocol upgrades and parameter changes.

Investment DAOs leverage Aragon's treasury management tools. The sub-governance plugin from Libree enables specific wallets to manage assets. Multi-signature integration with Safe provides additional security layers for large capital pools.

Gaming guilds deploy on Aragon for contribution tracking. The Dual Token Voting Plugin separates governance tokens from non-transferable citizenship tokens. This prevents pure speculation while maintaining community direction control.

DePIN projects on Peaq use Aragon for Machine Economy governance. The framework handles voting for IoT device networks and data marketplace operations. Cross-chain capabilities allow coordination across multiple blockchain ecosystems.

ANT Token Performance 2023-2025

Data: CoinMarketCap, CoinGecko price feeds, exchange data aggregation

ANT currently trades at $0.13-$0.20 depending on the exchange. Market capitalization sits at $5.73 million as of November 2025. The token reached an all-time high of $14.79 in April 2021 but declined 99.1% from that peak.

Trading volume remains minimal at around $300-$400 per day. The Aragon Association dissolved in November 2023, offering token redemption at 0.0025376 ETH per ANT. This redemption window closed November 2024. Approximately 10,480 holders remain according to on-chain data.

ANT functions purely as governance now. Token holders vote on Aragon Network development through the Aragon DAO. The MiniMe standard enables snapshot-based voting without double-counting. ANTv2 introduced gasless transfers and reduced transfer costs by 67%.

DAO Growth Statistics 2023-2025

Data: Dune Analytics dashboards, on-chain treasury tracking, Aragon ecosystem reports

The DAO ecosystem grew at 30% CAGR between 2021 and 2024. Over 13,000 active DAOs exist worldwide as of 2025. Community DAOs represent 62% of all organizations. DeFi DAOs control $7.5 billion in assets with 70 organizations.

Aragon-powered DAOs secured over $12 billion in value historically. Current active treasury management exceeds $6 billion across the platform. This includes both direct holdings and staked assets in DeFi protocols.

Security Overview

Aragon undergoes regular third-party audits. The latest Halborn audit covered code committed through February 2025. No high-severity issues were found in the current OSx implementation.

The March 2023 Code4rena audit identified four medium-severity vulnerabilities. All issues related to reentrancy risks in the execute function. The team addressed these concerns before mainnet deployment. The updated architecture prevents malicious proposals from creating unexpected call patterns.

Permission management prevents common governance attacks. Granular controls limit which addresses can execute specific actions. The system requires explicit approval for treasury movements and contract upgrades.

No major exploits have affected Aragon infrastructure in 2025. The modular plugin system isolates potential vulnerabilities. If a plugin contains bugs, other DAO functionality remains secure. This contrasts with monolithic systems where single exploits can compromise entire organizations.

Technical Capabilities Comparison

| Feature | Aragon | Snapshot | Tally | DAOhaus |

|---|---|---|---|---|

| No-code setup | Yes | Yes | Partial | Yes |

| On-chain execution | Yes | No (requires pairing) | Yes | Yes |

| Plugin system | Yes (modular) | Yes (strategies) | Limited | Limited |

| Multi-chain support | 9 chains | 30+ chains | 5 chains | 6 chains |

| Custom branding | Yes (2025 update) | Limited | No | Limited |

| Treasury analytics | Yes | No | Yes | Yes |

| ENS integration | Yes (dao.eth) | Yes | Yes | No |

Data: Platform documentation, feature comparison testing, developer portal analysis

Future Development Roadmap

Direct smart contract upgrades through the Aragon App UI are coming in late 2025. Legacy DAOs will access new features including the Governance Designer without developer help. This completes a major milestone for no-code governance evolution.

zkSync and LayerZero integrations enable governance of assets across chains from one mainnet DAO. Cross-chain voting will let organizations control treasuries on multiple networks simultaneously. This addresses fragmentation in multi-chain protocols.

AI integration appears in roadmap discussions. Automated treasury management and proposal analysis tools are under development. Sentiment tracking for community mood will inform governance decisions.

The June 2025 app update will replace earlier versions. All builders get seamless access to adaptable and modular governance features. Custom theming will allow complete white-label experiences for organizations.

Limitations and Considerations

Aragon requires on-chain transactions for voting. This creates gas costs for participants, especially on Ethereum mainnet. Layer 2 deployments mitigate this but add network-switching complexity for users.

The learning curve exceeds simpler alternatives like Snapshot. Setting up permission structures demands understanding of smart contract interactions. Organizations need technical advisors even with the no-code interface.

Token-weighted voting can lead to plutocracy. Wealthy holders control decisions unless DAOs implement reputation systems. The Dual Token Voting Plugin addresses this but requires additional setup complexity.

ANT token value declined dramatically from its 2021 peak. This raises questions about long-term sustainability. The platform operates independently of token price but governance participation requires holding ANT.

Switching from other frameworks involves migration complexity. Organizations on Snapshot or Moloch face technical hurdles moving to Aragon. Treasury movements and member records require careful planning.

Frequently Asked Questions

Sources and References

Aragon Official Resources:

Aragon Website, Aragon Blog, Aragon GitHub Repository, Aragon Developer Portal

Industry Reports and Analysis:

DeFiLlama Analytics, Dune Analytics Dashboards, Code4rena Audit Report (March 2023), Halborn Security Audit (November 2024 - February 2025)

Market Data:

CoinMarketCap Price Data, CoinGecko Market Statistics, Changelly Price Predictions, CoinCodex Technical Analysis

Comparative Research:

Markaicode DAO Platforms Comparison, Sablier DAO Governance Guide, DAO Times Comprehensive Tooling Guide, Alchemy DAO Tools List

Statistical Sources:

Decentralized Autonomous Organizations Statistics 2025 by CoinLaw, QuickNode Development Guides, Medium Platform Comparisons