WebSlinger And The Rise And Fall Of ApeCoin DAO Governance

Executive Summary

In February 2023, ApeCoin DAO selected WebSlinger as administrator for the APE Foundation through competitive RFP process. WebSlinger received $75,000 monthly compensation to handle legal, compliance, finance, operations, and treasury functions for the Cayman Islands entity.

The arrangement lasted until June 2025, when AIP-596 passed with 99.19% approval, dissolving ApeCoin DAO entirely. WebSlinger's role ended as governance transferred to ApeCo, a new Yuga Labs entity. The decision reflected concerns about inefficient resource allocation and declining participation.

As of November 2025, ApeCoin trades at $0.36 with $397 million market cap. ApeChain's TVL dropped 80% from $33.8 million peak to $6.7 million. The ecosystem shifted from decentralized governance to centralized operational control under Yuga Labs leadership.

WebSlinger Selection Process and Initial Term

RFP Competition in February 2023

APE Foundation launched administrator search in early February 2023. Working Group Zero managed the request for proposal process. Four vendors submitted applications: WebSlinger, Autonomous, Lemma, and Provenance.

WG0 evaluated candidates across four categories. Knowledge and work experience carried 40 points maximum. Ability to meet deadlines and value/price categories each offered 25 points. Capacity and redundancy contributed 10 points.

| Vendor | Knowledge & Experience (40 pts) | Deadlines (25 pts) | Value & Price (25 pts) | Capacity (10 pts) | Total |

|---|---|---|---|---|---|

| WebSlinger | 40 | 25 | 25 | 10 | 100 |

| Autonomous | 32 | 25 | 25 | 10 | 92 |

| Lemma | 28 | 25 | 25 | 10 | 88 |

| Provenance | 25 | 25 | 25 | 10 | 85 |

Data: ApeCoin DAO Forum, Working Group Zero evaluation

Key Selection Factors

WG0 chose WebSlinger based on superior crypto/Web3 experience. The firm offered CFO services through global entity structure. WebSlinger demonstrated commitment to decentralize DAO operations.

WebSlinger partnered with Crestbridge Cayman Limited, a regulated service provider. This arrangement cost 50% less than previous administrator Cartan Group. The partnership began March 1, 2023 with 12-month renewable terms.

Compensation Structure

Monthly remuneration totaled $75,000. Payment split 75% USDC stablecoin and 25% ApeCoin. Annual cost reached $900,000 for administrative services.

Special Council members received $20,833 monthly ($250,000 annually) in early 2023. Later reduced to $125,000 annually for new members. Combined leadership costs exceeded $1.6 million yearly at peak.

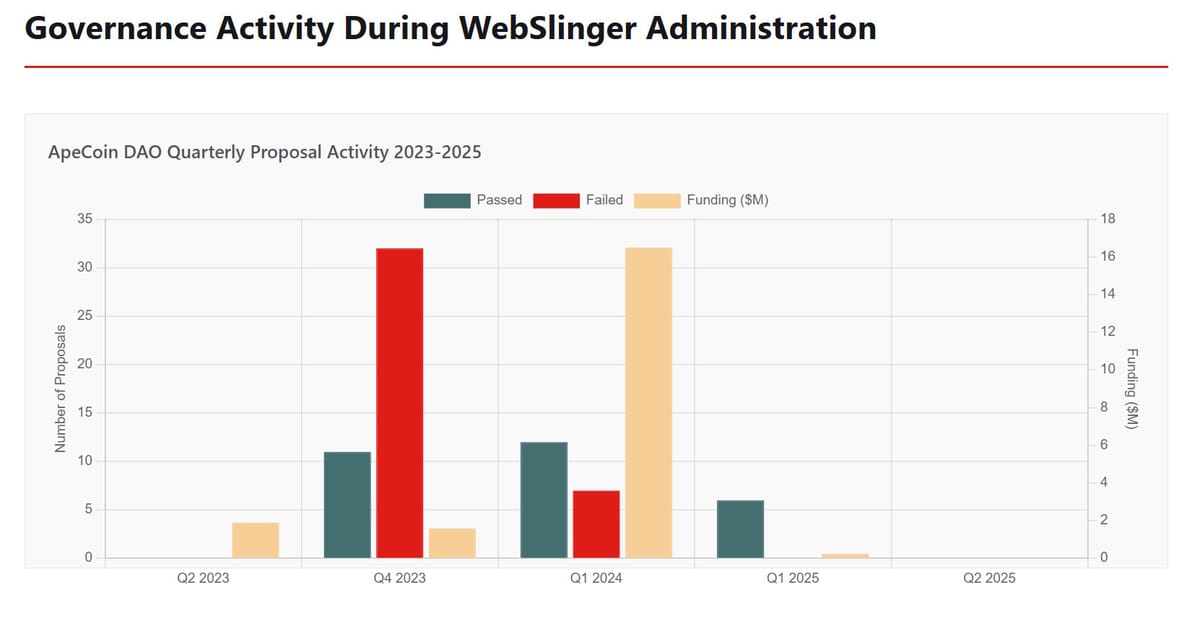

Governance Activity During WebSlinger Administration

Data: Messari State of ApeCoin reports Q2 2023 - Q2 2025

Voting Trends and Participation

Q2 2023 saw declining engagement across all metrics. Transfer volume and governance votes dropped from earlier highs. APE price fell 32% that quarter despite stable market conditions.

Q4 2023 produced 53 proposals: 11 passed, 32 failed, 10 elections/multiple choice. Failed AIPs proposed $57.4 million spending. Passed proposals allocated only $1.6 million, showing selectivity.

Q1 2024 reviewed 20 proposals: 12 passed, 7 failed, 1 multiple choice. Total approved funding reached $16.5 million, up 914% quarter-over-quarter. The increase reflected major initiatives like ApeChain development and Formula One partnership.

| Quarter | Total Proposals | Passed | Failed | Elections/Other | Approved Funding |

|---|---|---|---|---|---|

| Q2 2023 | N/A | N/A | N/A | N/A | $1.9M |

| Q4 2023 | 53 | 11 | 32 | 10 | $1.6M |

| Q1 2024 | 20 | 12 | 7 | 1 | $16.5M |

| Q1 2025 | 6 | 6 | 0 | 0 | $248K |

Data: Messari State of ApeCoin quarterly reports

Salary Controversy and Reform

June 2023 sparked debate over leadership compensation. Community member Vulkan posted organizational chart revealing monthly salaries. Secretary earned $7,000, governance facilitators $8,000, working group stewards $9,000.

Critics compared unfavorably to other DAOs. Aavegotchi DAO director earned under $8,000 annually with similar responsibilities. Defenders argued compensation matched tech industry rates and fiduciary liability.

AIP-350 passed in late 2023, cutting Special Council pay 50% for new members. This saved approximately $375,000 annually starting January 2024.

ApeChain Launch and Ecosystem Expansion

October 2024 Mainnet Debut

ApeChain launched October 20, 2024 at ApeFest Hong Kong. Horizen Labs led development using Arbitrum Orbit framework. The Layer-3 blockchain uses APE as native gas token.

APE price surged 130% in 24 hours, rising from $0.75 to $1.73. The rally reflected anticipation around automatic yield staking, NFT functionality, and cross-chain bridges.

Data: DefiLlama ApeChain analytics

Initial Success and Rapid Decline

TVL peaked at $33.8 million in December 2024. Banana Bill incentive program drove early adoption. LayerZero integration enabled cross-chain interoperability.

By November 2025, TVL dropped to $6.7 million - 80% decline from peak. Only 3 of nearly 30 protocols generate revenue. Two earned under $100 in 24 hours.

APE price fell 95% from launch, trading at $0.36 by November 2025. Market analysts attribute decline to fading hype, token unlocks, sluggish NFT market.

| Metric | Oct 2024 Launch | Dec 2024 Peak | Nov 2025 Current | Change from Peak |

|---|---|---|---|---|

| ApeChain TVL | $8M | $33.8M | $6.7M | -80% |

| APE Price | $0.75 | $1.73 | $0.36 | -79% |

| Revenue-Generating Protocols | 15+ | 20+ | 3 | -85% |

| 24h DEX Volume | $800K | $1.2M | $46K | -96% |

Data: DefiLlama, CoinGecko, Messari Q2 2025 report

The DAO Dissolution: AIP-596

Yuga Labs Proposal for Structural Change

Greg Solano, Yuga Labs CEO, submitted AIP-596 on June 5, 2025. The proposal called for complete DAO wind-down. Governance would transfer to ApeCo, new Cayman-based entity.

Solano criticized existing structure: "What started with promise has devolved into sluggish, noisy and often unserious governance theater." He cited vanity proposals and low-impact initiatives draining resources.

Voting Process and Approval

Voting opened June 14, 2025 and closed June 26, 2025. The proposal required 3.5% of circulating tokens and 66% approval rate. Final result showed 99.19% approval.

Community reactions split between support and concern. Supporter TheDonDiablo welcomed "reset we've been needing with clearer ops." Critic Lanzer called it "bad optics" for rushed timeline.

Data: Messari State of ApeCoin Q1 2025, Q2 2025

Impact on WebSlinger and Leadership Structures

AIP-596 sunset all legacy governance structures. Special Council dissolved. WebSlinger's administrator role ended. The proposal/voting process stopped entirely.

ApeCo absorbed treasury management, funding decisions, operational control. Cameron Kates, former Ape Foundation executive director, joined ApeCo leadership alongside Banana Bill team members.

APE Foundation continues providing legal and administrative support during transition. The entity maintains registration in Cayman Islands but operates under ApeCo direction.

| Governance Element | Before AIP-596 | After AIP-596 | Status |

|---|---|---|---|

| Decision Authority | APE token holders via proposals | ApeCo (Yuga Labs entity) | Centralized |

| Special Council | 5 members at $125K-$250K/year | Dissolved | Eliminated |

| WebSlinger Role | Administrator at $75K/month | Role terminated | Ended June 2025 |

| Treasury Control | DAO multi-sig wallet | ApeCo direct management | Transferred |

| Proposal Process | AIP submission and voting | Internal ApeCo decisions | Discontinued |

| APE Foundation | Operational executor | Legal/admin support only | Reduced scope |

Data: Messari Q2 2025 report, ApeCoin DAO forum

ApeCoin Performance Metrics 2025

Price and Market Capitalization

Q1 2025 circulating market cap fell 56.7% to $375.7 million from $868.1 million Q4 2024. APE price dropped 60.9% from $1.20 to $0.47 by March 31.

Q2 2025 showed partial recovery. Market cap increased 30.1% to $488.9 million. Price rose from $0.47 to $0.61. By November 2025, price retreated further to $0.36 with $397 million market cap.

Data: Messari Q1-Q2 2025 reports, DefiLlama

Trading Volume and Wallet Activity

Q1 2025 DEX volume totaled $285.8 million, down 21.7% from Q4 2024's $365 million. Sharks ($1M-$10M daily trading) contributed 58.6% of volume.

Q2 2025 DEX volume reached $16.6 million. Seals and sharks dominated trading activity. New token holders decreased 24.6% to 15,765 addresses from 20,908 in Q1.

Staking Rewards Distribution

Q1 2025 distributed 3.8 million APE in staking rewards. BAYC holders claimed 2.7 million (71.1%). MAYC holders received 781,600 (20.7%). BAKC holders got 108,954 (2.9%). APE token holders claimed 207,524 (5.5%).

Q2 2025 saw 4.1 million APE claimed, up 7.5%. BAYC holders maintained 66.4% share. MAYC holders increased to 26.7%. BAKC rose to 5.4%. APE token holder share dropped to 3.5%.

| Holder Category | Q1 2025 Claims | Q1 Share | Q2 2025 Claims | Q2 Share | Change |

|---|---|---|---|---|---|

| BAYC Holders | 2.7M APE | 71.1% | 2.7M APE | 66.4% | Flat volume |

| MAYC Holders | 781.6K APE | 20.7% | 1.1M APE | 26.7% | +40.8% |

| BAKC Holders | 109K APE | 2.9% | 222.3K APE | 5.4% | +104% |

| APE Token Holders | 207.5K APE | 5.5% | 143.2K APE | 3.5% | -31% |

Data: Messari State of ApeCoin Q1 2025, Q2 2025

Comparing WebSlinger Era to ApeCo Structure

Operational Efficiency Arguments

Yuga Labs argued DAO coordination proved inefficient. Proposal submission and voting consumed weeks. Low participation rates affected legitimacy. Treasury spending lacked strategic direction.

ApeCo promises faster execution on key priorities: ApeChain development, BAYC brand expansion, Otherside metaverse. Centralized control eliminates multi-stakeholder approval delays.

Community Concerns About Centralization

Critics note token holder influence disappeared entirely. No voting rights remain on funding allocation. ApeCo operates without public oversight mechanisms.

Supporters counter that DAO fatigue was real. Many proposals consumed resources without results. Professional management may deliver better outcomes than crowd governance.

Financial Impact

DAO operational costs exceeded $2 million annually at peak. Special Council, WebSlinger, working group stewards, facilitators all drew salaries. AIP evaluation and implementation required dedicated teams.

ApeCo structure reduces administrative overhead. Cameron Kates and core team replace distributed governance layer. Savings may redirect toward product development and marketing.

Data: ApeCoin Forum salary disclosures, Messari reports

Current State and Future Outlook

Ecosystem Health Indicators

As of November 2025, ApeCoin ecosystem shows mixed signals. ApeChain struggles with 80% TVL decline. Price remains 95% below all-time high. Revenue generation minimal across protocols.

BAYC floor price dropped to 5.9 ETH from 10-13 ETH range at ApeChain launch. Collection maintains second-largest NFT market cap at $206 million behind CryptoPunks.

Cross-chain expansion continues through Project R.A.I.D. Integration with Solana and Hyperliquid adds utility. ApePay Terminal enables real-world payments. Adoption remains modest.

Regulatory Clarity

October 2025 court ruling determined APE and BAYC NFTs are not securities. SEC ended investigation without enforcement action. This removed major uncertainty hanging since October 2022.

Legal clarity failed to spark price recovery. Market response remained muted. Analysts note broader NFT market weakness throughout 2024-2025 cycle.

Comparison to Broader DAO Trends

ApeCoin's trajectory mirrors wider pattern. Early-stage DAOs often transition to streamlined control. Aragon, MakerDAO, others underwent similar restructuring.

Capital consolidates around largest ecosystems. Base and Arbitrum dominate L2 space. Aave controls 80% of Ethereum lending market. Mid-tier chains struggle for relevance.

ApeChain competes in saturated environment. Abstract, other branded chains face similar TVL declines. Success requires sustained developer activity and user adoption.

Frequently Asked Questions

Sources and References

Primary Sources:

Messari - State of ApeCoin Q2 2023, Q4 2023, Q1 2024, Q4 2024, Q1 2025, Q2 2025

ApeCoin DAO Forum - AIP-596 proposal, WebSlinger formal bid, RFP documentation

DefiLlama - ApeChain TVL and protocol analytics

Secondary Sources:

CoinDesk - ApeCoin DAO Special Council Six-Figure Salaries article

Coincu - Yuga Labs Proposes ApeCoin DAO Dissolution analysis

Cointelegraph - Yuga Labs Seeks to Replace ApeCoin DAO With ApeCo coverage

The Defiant - One Year On: Inside ApeChain's Brief Rise and Slow Fall

CoinMarketCap - Latest ApeCoin News and price predictions

NFT Now - ApeCoin DAO Under Fire for Leadership Salary Payouts