Analysis of Mantra Token 90% Crash and Recovery Strategies (Based on 17 sources)

Mantra (OM) operates as a blockchain project centered on real-world asset (RWA) tokenization with regulatory compliance as its cornerstone. Built using the Cosmos SDK, the Mantra Chain supports Inter-Blockchain Communication (IBC) protocol and CosmWasm, allowing compatibility across the Cosmos ecosystem.

The project positions itself as a "security-first L1 blockchain for real-world assets," offering a permissioned framework for tokenizing and trading physical assets while adhering to regulatory requirements. Mantra aims to simplify user experience in asset tokenization, including real estate, commodities, and traditional financial instruments.

The Collapse: What Happened?

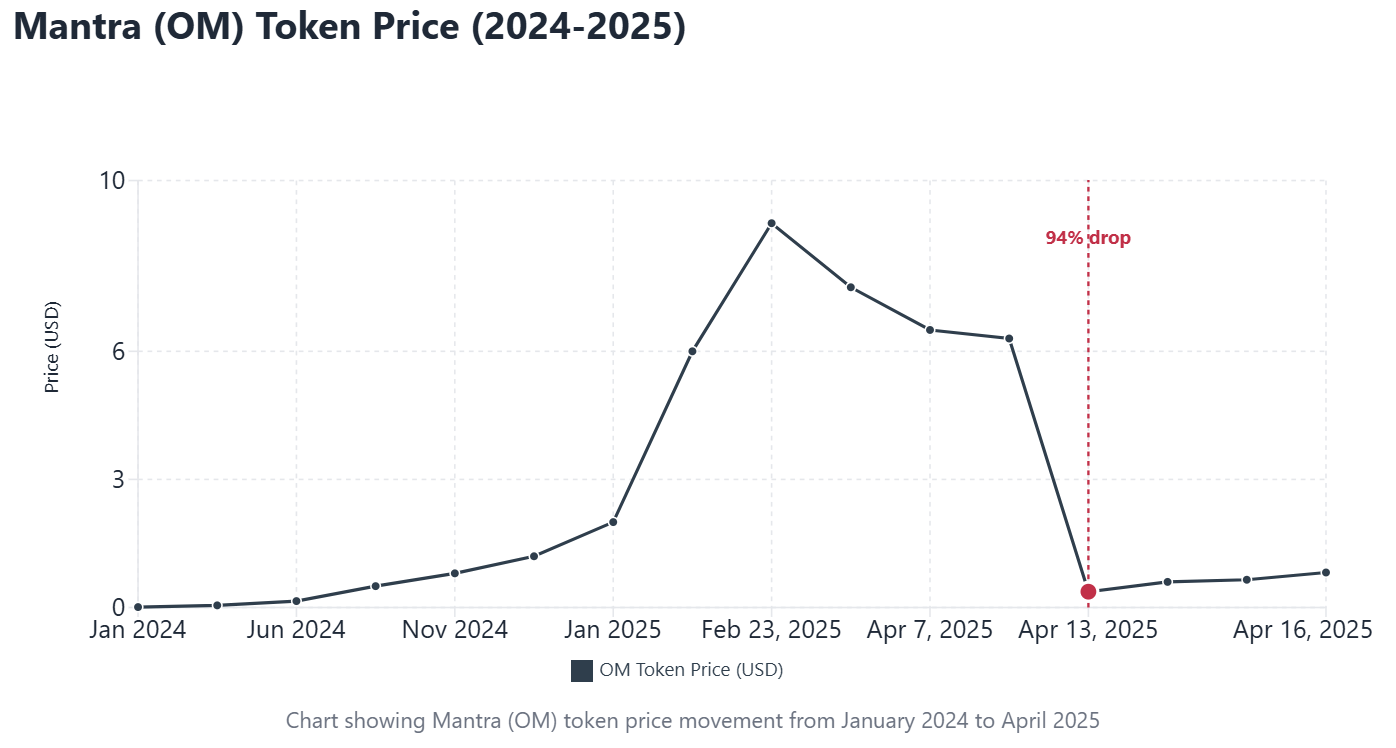

On April 13, 2025, the OM token price plunged over 90% within hours, dropping from approximately $6.30 to below $0.50. This dramatic fall reduced Mantra's market capitalization from more than $6 billion to roughly $681 million.

According to market data, the crash occurred during low liquidity hours (Sunday evening UTC/early morning in Asia), when trading activity typically reaches its lowest points. The event triggered mass liquidations of futures positions, with leveraged traders losing over $50 million.

The Mantra Team's Explanation

Mantra co-founder John Patrick Mullin stated that the price collapse resulted from "reckless forced liquidations" executed by centralized exchanges. Mullin noted that "the timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice."

In an interview with Coinage, Mullin denied accusations of price manipulation or insider selling. He asserted that all team and investor tokens remain locked according to publicly disclosed vesting schedules.

Mullin further clarified his understanding that "a massive force liquidation on an exchange over the weekend" occurred. While he didn't name the specific exchange, he mentioned they are "starting to get exactly why they did what they did." Mullin added that "the exchange took over a bunch of different positions and completely just closed them out," though the reasons behind this action continue to be investigated.

Controversy and Skepticism

Despite the team's explanations, accusations of a "rug pull" circulated throughout the crypto community. Many analysts and social media users questioned the legitimacy of blaming exchange liquidations as the sole cause for such a sharp decline.

In a discussion with Coffeezilla, Mullin acknowledged that the team sold tokens worth $25-45 million through over-the-counter (OTC) deals at 30-50% discounts, then used $5-10 million to buy back OM. Coffeezilla considered this price manipulation, which Mullin refuted.

Disputes also arose regarding analysis from Arkham Intelligence suggesting Mantra investors, including Laser Digital, offloaded substantial amounts of OM tokens before the crash. Mullin contested these reports, claiming Arkham "mislabeled" wallets and that no key investors sold their positions.

Current Status and Recovery Efforts

As of April 16, 2025, the OM token has partially rebounded to approximately $0.80-0.81 from its low of $0.37, but still trades about 90% below its all-time high of $9.00 reached in February 2025.

John Patrick Mullin has declared that recovering the OM token is the team's "preeminent and primary concern." According to Mullin, they are developing a recovery plan that may include token buybacks and burns. He acknowledged they "are still in the early stages of putting together this plan."

On April 15, 2025, Mullin announced plans to burn all his personal team tokens (772,000 OM) as a goodwill gesture to restore investor confidence. He proposed that the community and investors could later decide if he had "earned them back." This announcement generated both praise for transparency and criticism from those who believe it could affect long-term team motivation.

The Mantra team is also considering using their $109 million Ecosystem Fund to stabilize OM's price through a buyback and burn program. Following Mullin's token burning announcement, OM's price rose 26%, suggesting renewed investor interest.

Future Outlook

Before the crash, Mantra had secured significant partnerships in the RWA tokenization space. A key collaboration was with DAMAC Group, a UAE-based real estate development conglomerate, aiming to tokenize assets worth at least $1 billion. Mantra's partner list also includes BlackRock, SwissBorg, Ondo, Chainlink, Kelpr, and Google Cloud.

Despite the recent crash, the long-term outlook for real-world asset (RWA) tokenization remains promising. Analysts believe this market could grow substantially in coming years, and Mantra, with its regulatory compliance focus, might maintain its position in this sector if it can restore investor trust.

According to technical predictions made before the crash, OM's price might have reached approximately $0.83 by May 2025, potentially exceeding $1 by 2026, but these forecasts will likely be adjusted given recent events.

Conclusion

The April 13, 2025 collapse of the Mantra (OM) token represents a significant event in the crypto market, reminding investors of the volatility and risks in the digital asset space. While the Mantra team attributes the fall to unexpected exchange liquidations, questions about project transparency and tokenomics management persist.

In the short term, Mantra's success depends on the effectiveness of their recovery plans, including token buyback and burning programs, and their ability to rebuild investor and community trust.

Long-term, Mantra's future as a project will be determined by broader trends in the RWA tokenization space and their capacity to deliver on stated partnerships and development plans, demonstrating real value and utility of their technology despite the recent setback.