Agora DAO Tool Report For 2025

What Is Agora

Agora is an open-source governance platform built to help crypto protocols coordinate decisions at scale. Founded in 2022 by Yitong Zhang, Charlie Feng, and Kent Fenwick, the platform serves major Ethereum projects including Uniswap, Optimism, ENS, and Nouns. The three co-founders met at Nouns DAO where they developed early governance tooling before launching Agora as a standalone company.

The platform provides zero-code deployment of governance frameworks. DAOs can launch full voting systems without hiring developers or writing smart contracts. Agora's technology is built on OpenZeppelin Governor contracts, which secure tens of billions in value across the Ethereum ecosystem.

Users can customize voting mechanisms, manage delegation, and execute proposals through an intuitive interface. The platform supports both on-chain and gasless voting, making participation accessible to token holders regardless of transaction costs. As of November 2025, Agora has processed over 800,000 votes from more than 103,000 users.

The platform is MIT-licensed, meaning any project can fork and deploy the code for free. This commitment to open-source development has attracted contributions from developers, governance tooling teams, and startups building on top of Agora's API. Learn more about DAO tooling options.

How Agora Works For DAO Governance

Core Governance Features

Agora offers modular governance components that DAOs can activate as they grow. Basic features include token-weighted voting where one token equals one vote. Advanced options include role management, which lets protocols assign different permissions to different stakeholders. Security councils can block or expedite certain proposals based on predefined rules.

The platform supports multiple proposal types. Simple proposals work for routine decisions like funding a grants program. More complex mechanisms handle protocol upgrades or treasury management. DAOs can set different thresholds for each proposal type, making low-stakes decisions easier while keeping critical changes difficult.

Delegation System

Delegation allows token holders to assign voting power to trusted representatives. This system helps large token holders participate in governance while maintaining security through custody solutions like Coinbase Custody or Anchorage. The platform tracks delegation relationships and displays delegate activity publicly.

Uniswap redistributed 8 million UNI tokens to active delegates through Agora's delegation campaign. This initiative increased both the number and quality of delegates participating in protocol governance according to the Uniswap Foundation.

Technical Architecture

Agora Governor 2.0 builds on OpenZeppelin's battle-tested contracts. The system includes gasless voting through relayers, meaning voters only sign messages rather than paying transaction fees. Proposals can be simulated before submission to verify they will execute correctly.

The platform integrates with Snapshot for off-chain signaling and Discourse for community discussions. APIs allow wallets and block explorers to display governance information. Smart contract upgrades happen through timelock controllers, giving the community time to review changes before execution.

Agora Client Portfolio And Market Position

Major Protocol Clients

| Protocol | Treasury Size | Governance Launch | Key Use Case |

|---|---|---|---|

| Uniswap | $2.8 billion | 2023 | Protocol upgrades and grants |

| Optimism | $7.9 billion | 2023 | Multiple choice voting and RPGF |

| ENS | $370 million | 2022 | Domain protocol governance |

| Ether.fi | Not disclosed | 2024 | Progressive decentralization |

| Derive | Not disclosed | 2024 | Rollup migration |

| Cyber | Not disclosed | 2024 | L2 governance |

| Xai Games | Not disclosed | 2024 | Gaming DAO coordination |

| B3 | Not disclosed | 2024 | Gaming infrastructure |

| Scroll | Not disclosed | Coming Soon | zkEVM governance |

Data: Agora.xyz and DeepDAO Treasury Analytics 2025

These protocols represent different segments of the Ethereum ecosystem. DeFi protocols like Uniswap manage trading infrastructure. Layer 2 networks like Optimism govern scaling solutions. Domain services like ENS control web3 naming systems. Gaming DAOs coordinate virtual economies.

Optimism's Token House uses Agora for multiple choice voting, allowing the community to allocate funding across competing proposals simultaneously. This mechanism replaced sequential yes/no votes, reducing voting fatigue and improving capital allocation. The list of active DAOs continues growing across multiple sectors.

Agora Growth Metrics For 2025

Data: Agora.xyz Public Metrics and Platform Analytics

Total votes cast on Agora reached 800,000 by Q3 2025, up from 350,000 in Q4 2024. The platform serves 103,000 unique users who have participated in governance. These numbers reflect growing adoption as more protocols migrate to Agora's infrastructure.

The business grew 10x in the past year according to co-founder Yitong Zhang in a January 2025 CoinDesk interview. This expansion came from both new client acquisitions and deeper integration with existing protocols. Revenue comes from setup fees, ongoing support contracts, and custom feature development.

In January 2025, Agora acquired Boardroom, a competing governance platform. Boardroom had tracked over 300 protocols and 2 million delegates through its API. The acquisition combined Agora's governance infrastructure with Boardroom's data analytics capabilities. Boardroom founder Kevin Nielsen joined as an advisor.

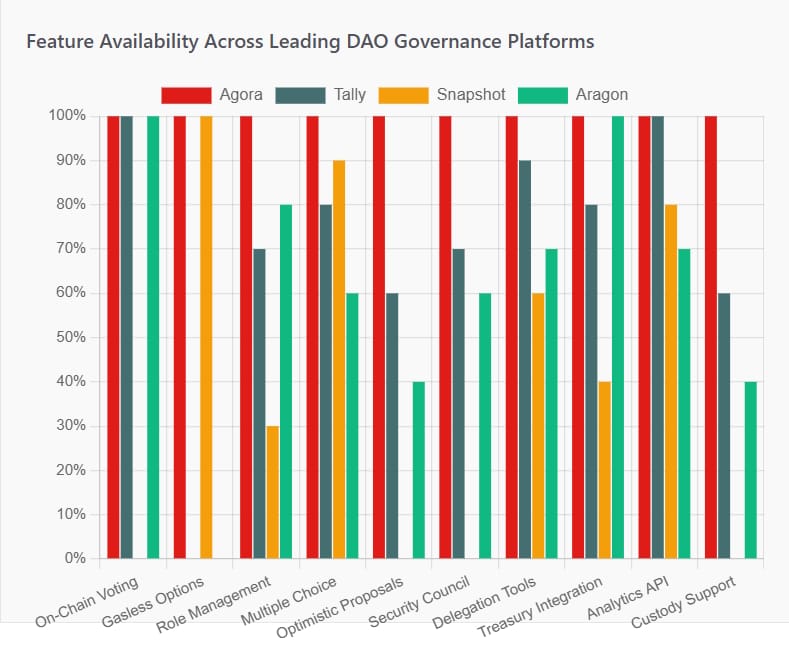

Agora Feature Comparison With Competitors

Governance Platform Analysis

Data: Platform Documentation and Feature Comparison 2025

| Platform | Deployment Type | Transaction Fees | Open Source | Target Market |

|---|---|---|---|---|

| Agora | On-chain with gasless | Optional (relayer covers) | Yes (MIT License) | Major protocols and L2s |

| Tally | On-chain only | Required (user pays) | Partial | All DAO sizes |

| Snapshot | Off-chain only | None | Yes | Signaling and polling |

| Aragon | On-chain modular | Required (user pays) | Yes | General DAO creation |

| DAOhaus | On-chain (Moloch v3) | Required (user pays) | Yes | Community and funding DAOs |

Data: DAO Tooling Comparison Research 2025

Competitive Advantages

Agora differentiates through custom enterprise features. Role management lets protocols give proposal rights to specific addresses. Optimistic proposals allow certain actions without full votes if no one objects. Security councils can veto proposals that threaten protocol safety.

The platform handles institutional custody integrations. Large token holders can delegate through Coinbase Custody or Anchorage without moving funds. This makes governance accessible to entities with strict security requirements.

Gasless voting removes participation barriers. Voters sign messages off-chain while relayers submit transactions. This reduces costs from dollars per vote to fractions of a cent. The feature helps DAOs maintain decentralization without requiring token holders to hold ETH for gas.

Competitor Strengths

Snapshot remains the leader for off-chain voting with no transaction costs. It supports 15,000 active spaces and processes millions of votes monthly. The platform works well for temperature checks and community polling before on-chain execution.

Tally provides broader market coverage with support for 10x more on-chain DAOs than competitors. Its free tier attracts smaller DAOs that cannot afford custom implementations. The platform offers strong analytics and transparency features.

Aragon serves the no-code DAO creation market. Users can deploy a full DAO in minutes without technical knowledge. The platform provides templates for different organization types and manages both governance and treasury functions.

Major Developments In 2025

Boardroom Acquisition

In January 2025, Agora acquired Boardroom to expand its governance data capabilities. Boardroom had built APIs tracking 300 protocols and 2 million delegate profiles. The acquisition created the most complete governance data platform in crypto.

Both products continue operating independently while teams work on integration. Boardroom's newsfeed and API remain active for wallet providers and developers. The deal value was not disclosed, but industry observers valued Boardroom's data infrastructure and client relationships.

Agora Governor 2.0

The platform released Governor 2.0 with enhanced modularity and security features. New capabilities include multiple choice voting for resource allocation, approval voting where voters select multiple options, and conviction voting where vote weight increases over time.

Transaction simulation improved with better error messaging. Proposals now show exact execution steps before submission. This reduces failed proposals and helps voters understand what they approve. The upgrade maintains backward compatibility with existing deployments.

World Foundation Partnership

In June 2025, Agora partnered with World Foundation to build the World Vote Mini App. The application uses Agora Governor 2.0 combined with World ID for verified human voting. This prevents sybil attacks where one person creates multiple identities to gain voting power.

The mini app lets World ID holders vote on experimental proposals for the World community. It represents Agora's first major implementation outside Ethereum mainnet governance. The system verifies human uniqueness while preserving privacy through zero-knowledge proofs.

Market Position Growth

The DAO governance market reached $170 million in 2024 and projects to $333 million by 2031. DAOaaS platforms specifically are growing from $123.6 million in 2023 toward $680.6 million by 2033. Agora captures a growing share as more protocols adopt on-chain governance.

Industry insiders see 2025 as a turning point for DAO adoption. Zhang told CoinDesk that businesses are returning to DAOs after trauma from previous hype cycles. Regulatory clarity under new administration policies may accelerate this trend through clearer token issuance guidelines.

DAO Market Context And Industry Trends

Data: DeepDAO and DAOlytics Treasury Analysis Q3 2025

DAOs collectively hold $21.4 billion in liquid treasury assets as of 2025. DeFi protocols dominate with $7.5 billion across 70 DAOs. Infrastructure DAOs manage $800 million through 30 organizations. Venture capital and investment DAOs control $200 million despite having only 25 members.

Over 13,000 active DAOs operate globally in 2025, up from 4,227 in early 2022. Community DAOs represent 62% of this total. The Asia-Pacific region leads expansion driven by growth in China, South Korea, and India. Non-financial DAOs in gaming, media, and content increased 25% year-over-year on platforms like DAOhaus and Aragon.

Governance participation remains a challenge. Out of 6.9 million governance token holders, only 2.1 million actively vote on proposals. Low participation concentrates power among engaged token holders. Protocols experiment with quadratic voting, delegation markets, and reputation systems to improve engagement.

The market expects 60% of blockchain projects to incorporate DAO structures by end of 2025. This represents a shift from centralized foundations toward progressive decentralization. Projects launch with core teams but gradually transfer control to token holders through governance.

Security And Technical Reliability

Smart Contract Security

Agora builds on OpenZeppelin Governor, which secures over $30 billion in protocol value. OpenZeppelin contracts undergo continuous audits and have been battle-tested across thousands of deployments. The code is open source, allowing community security researchers to identify and report vulnerabilities.

The platform uses timelock controllers for governance actions. Proposals that pass must wait a predetermined period before execution. This delay gives stakeholders time to review changes and exit if they disagree with governance decisions. Emergency actions can bypass timelocks through security council mechanisms.

Multi-signature safeguards protect against unauthorized changes. Critical functions require signatures from multiple parties before execution. This prevents single points of failure and reduces risks from compromised private keys.

No Major Security Incidents Reported

Research found no public security incidents involving Agora's governance infrastructure through November 2025. The platform has not experienced contract exploits, unauthorized proposal executions, or vote manipulation attacks.

This security record comes from conservative engineering practices. Agora extends proven OpenZeppelin contracts rather than building from scratch. New features undergo internal review before deployment. The company maintains a bug bounty program for external security researchers.

Broader DAO security challenges exist at the protocol level. Some DAOs have lost funds through poor treasury management or approved malicious proposals. These issues stem from governance processes rather than platform vulnerabilities. Education around secure governance practices remains an industry priority.

Implementation Process And Requirements

Getting Started With Agora

Protocols contact Agora through their website to discuss governance needs. The sales process includes requirements gathering, architecture design, and implementation planning. Agora provides white-glove service for enterprise clients with dedicated support throughout deployment.

Implementation time varies by complexity. Simple setups using standard governor contracts can launch in weeks. Custom features like role management or multiple voting mechanisms require longer development cycles. Most protocols go live within one to three months.

The platform offers flexible pricing. Small projects can fork the open-source code and self-host for free. Larger protocols pay for hosted solutions, ongoing support, and custom feature development. Exact pricing is not public but scales based on protocol size and requirements.

Technical Requirements

Protocols need governance tokens compatible with ERC20 or similar standards. Voting power typically derives from token balance snapshots at proposal creation. Alternative weighting mechanisms can account for staked tokens, liquidity positions, or delegation relationships.

Treasury management requires multisig wallets or similar custody solutions. Gnosis Safe is the most common choice for DAO treasuries. Proposals can execute transactions against these wallets once voting completes and timelocks expire.

Community infrastructure includes Discourse for long-form discussion and Discord for real-time coordination. Agora integrates with both platforms to display proposal information where communities already gather. APIs allow custom integrations with other tools.

Migration From Other Platforms

Protocols can migrate from Snapshot or other platforms to Agora's on-chain governance. The transition typically happens gradually with Snapshot continuing for signaling while critical decisions move on-chain. This hybrid approach maintains community engagement during the learning curve.

Derive Protocol migrated governance from Ethereum mainnet to its rollup using Agora. The move reduced voting costs and increased participation. Agora handled the technical migration while Derive managed community communications about the change.

Pros And Cons Of Agora Platform

Advantages

Enterprise-grade features: Role management, security councils, and proposal types give protocols fine-grained control. These features handle complex governance needs that simpler platforms cannot support.

Gasless voting option: Relayers cover transaction costs, removing financial barriers to participation. This keeps governance accessible even when Ethereum gas prices spike.

Battle-tested infrastructure: Building on OpenZeppelin Governor provides security guarantees and reduces risk. The contracts have years of production use across major protocols.

Open source commitment: MIT licensing allows any project to fork and modify the code. This prevents vendor lock-in and supports ecosystem development.

Strong client portfolio: Major protocols like Uniswap and Optimism validate the platform's capabilities. These reference implementations help new clients understand what Agora can deliver.

Institutional custody support: Integration with Coinbase Custody and Anchorage makes governance accessible to large token holders with strict security requirements.

Disadvantages

Higher cost than alternatives: Enterprise features come with enterprise pricing. Small DAOs may find Snapshot or other platforms more affordable for basic needs.

Technical complexity: Advanced features require more setup and configuration than simple voting platforms. Protocols need technical capacity to design and maintain governance systems.

Limited self-service options: The platform targets enterprise clients rather than self-service DAO creators. Projects wanting quick launches without consultation may prefer platforms like Aragon or DAOhaus.

Learning curve for voters: On-chain voting with multiple proposal types can confuse new participants. Communities need education materials to help members understand governance processes.

Ethereum focus: While some clients use Layer 2 networks, Agora primarily serves the Ethereum ecosystem. DAOs on other chains must look elsewhere for governance infrastructure.

Future Roadmap And Industry Outlook

Platform Development Plans

Agora continues building advanced voting mechanisms. Future releases will add ranked choice voting for selecting among multiple candidates. Quadratic voting may help reduce plutocracy by making additional votes more expensive. Conviction voting allows community members to signal long-term support for proposals.

Cross-chain governance represents another frontier. Protocols want to manage assets and decisions across multiple networks. Agora explores bridge integrations and message passing protocols to coordinate governance actions on different chains.

AI integration could help with proposal summarization and analysis. Large protocols produce hundreds of proposals annually. Automated tools could help voters understand complex proposals faster and identify potential issues before voting.

Industry Trends Affecting Agora

Regulatory clarity will accelerate DAO adoption if authorities provide clear token issuance guidelines. The Trump administration has indicated support for crypto innovation. Clear rules about sufficient decentralization could help protocols launch tokens without legal uncertainty.

Layer 2 networks continue gaining traction for governance. Base, Arbitrum, and Optimism offer lower transaction costs than Ethereum mainnet. DAOs save money by moving governance to L2s while maintaining Ethereum security guarantees through settlement.

Real-world asset integration brings new complexity to DAO governance. Protocols begin holding treasury bonds, real estate, and equity stakes alongside crypto assets. This diversification requires sophisticated governance processes for managing traditional financial instruments.

Voter participation tools will improve. Delegation markets let people earn income by representing other token holders. Reputation systems reward consistent participation. These mechanisms address the persistent challenge of low voter turnout in DAO governance.

Frequently Asked Questions About Agora

Sources

CoinDesk: DAO Governance Platform Agora Acquires Older Competitor, Boardroom (January 2025)

Agora.xyz: Official website and product documentation

Agora GitHub: Open source repositories and technical documentation

DeepDAO: DAO treasury and governance statistics

Market.us: DAO-as-a-Service Market Report (November 2024)

Coinlaw.io: Decentralized Autonomous Organizations Statistics 2025

PatentPC: DAO Growth Stats: Treasury Sizes and Governance Activity

Intel Market Research: Decentralized Autonomous Organization Development Market Outlook 2025-2032

Sablier Blog: DAO Governance Voting Tools: The Ultimate Guide

Markaicode: DAO-as-a-Service Platforms Compared 2025

Crypto Briefing: Agora Raises $5M to Solve Protocol Governance (May 2024)