Aave V3 on zkSync Era in 2025 Brings Decentralized Lending to ZK Rollup Ecosystem

Overview

Aave V3 launched on zkSync Era mainnet in August 2024, bringing decentralized lending to the ZK-rollup ecosystem. The deployment followed community governance approval in November 2022 when 99.98% of voters supported the initiative.

zkSync Era uses zero-knowledge proof technology to process transactions off-chain while maintaining Ethereum security. The network achieves over 15,000 transactions per second with one-second finality and near-zero transaction fees according to October 2025 Atlas upgrade specifications. Matter Labs, the team behind zkSync, partnered with Aave DAO to deploy the protocol.

The integration faced technical delays. A compiler bug was discovered during final testing in August 2024. Matter Labs released updated compilers (zksolc v1.5.3 and zkvyper v1.5.4) on August 27, 2024. The bug affected bytecode generation but did not compromise existing contracts on zkSync Era.

BGD Labs handled deployment on behalf of Aave DAO after technical evaluation. Chaos Labs conducted risk analysis. Chainlink provides price feeds through oracle integration. Initial supported assets include USDC, USDT, WETH, and wstETH.

In October 2025, zkSync launched Atlas upgrade, introducing unified liquidity architecture that enables direct access to Ethereum L1 liquidity. The upgrade attracted institutional interest from 30+ organizations including Citibank. Ethereum co-founder Vitalik Buterin publicly endorsed Atlas as "underrated and valuable" for Ethereum's scalability.

Current Market Position November 2025

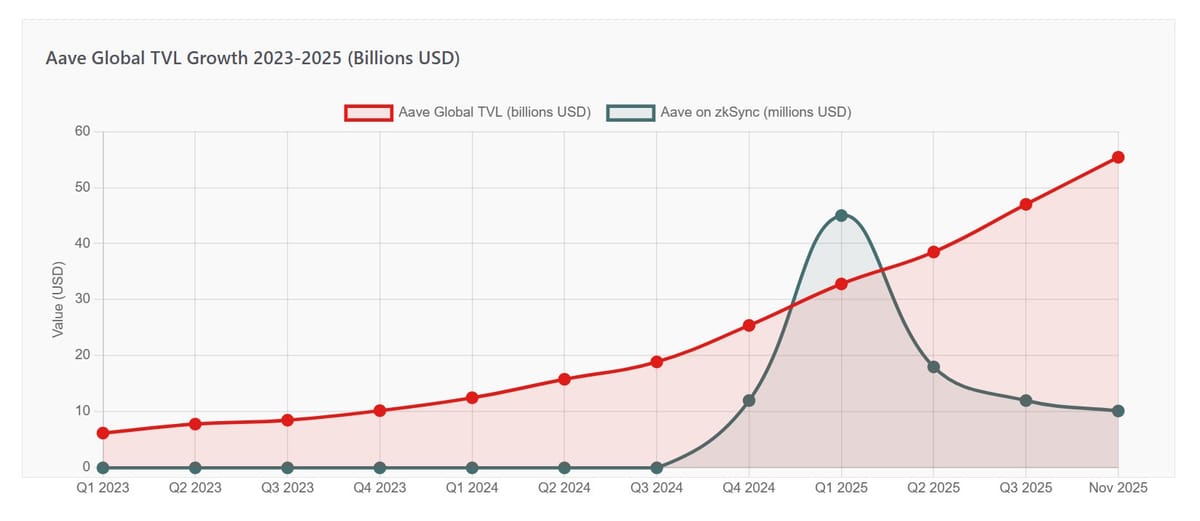

As of November 2025, Aave V3 holds $10.14 million TVL on zkSync Era according to DefiLlama data. This represents a small portion of Aave's global presence.

Globally, Aave protocol reached $55.4 billion in TVL by November 2025. The platform expanded to 18 networks throughout 2024-2025. Aave commands approximately 60-62% of DeFi lending market share and controls 80% of outstanding debt on Ethereum according to The Block analysis.

Aave showed exceptional efficiency in zkSync's Ignite Program, achieving 43.47 TVL growth per $1 of incentive. This efficiency rating topped all participating protocols during the campaign period from January through March 2025.

zkSync Era DeFi adoption remains in early stages. As of October 27, 2025, the network recorded 10,400 daily active addresses. Total DeFi TVL across zkSync Era stays in tens of millions, trailing other Layer 2 solutions like Arbitrum and Optimism.

Data: DefiLlama, The Block, Aave Protocol Reports

The protocol's market presence rivals mid-tier U.S. banks with combined supply and borrowing volumes over $70 billion as of August 2025. Monthly active users across all networks stand at approximately 99,200.

However, zkSync deployment faces adoption challenges. TVL peaked during Ignite Program incentives in January-March 2025 but declined after incentive periods ended. The network must attract sustainable liquidity beyond temporary reward programs.

zkSync Era Lending Market Landscape

Multiple lending protocols compete on zkSync Era. ZeroLend emerged as the native competitor with specialized zkSync features.

| Protocol | Global TVL | zkSync Era Launch | Key Differentiators | Governance |

|---|---|---|---|---|

| Aave V3 | $55.4B | August 2024 | Battle-tested code, 18 networks, flash loans, institutional trust | AAVE token DAO |

| ZeroLend | $56.3M | March 2024 | Native zkSync features, gasless transactions, RWA roadmap | ZERO token |

| Venus Protocol | $2.0B | 2024 | Venus Prime rewards, omnichain strategy | XVS token DAO |

Data: DefiLlama (November 2025), Protocol Documentation

Aave brings established reputation and proven security track record since 2017. The protocol underwent multiple security audits and maintains bug bounty program with rewards up to $1 million. However, it lacks zkSync-specific features like native account abstraction.

ZeroLend, built specifically for zkSync, leverages account abstraction for gasless transactions through paymaster functionality. The protocol forked Aave V3 codebase but added zkSync-native innovations. ZeroLend maintains insurance fund for user protection, unique among zkSync lending protocols.

The protocol plans Real World Assets integration including Treasury Bills, bonds, and real estate. This could unlock trillions in potential collateral according to industry estimates. Privacy layer using zkStack technology is planned for deployment.

Venus Protocol expanded to zkSync as part of omnichain strategy across eight networks. Venus Prime rewards XVS stakers with protocol revenue. The platform offers liquid staking token support including wstETH and liquid restaking tokens.

Competition centers on user experience versus proven reliability. Aave offers institutional-grade security. Native protocols provide better integration with zkSync features. Users must weigh these tradeoffs based on risk tolerance and feature preferences.

Technical Architecture and Performance

Aave V3 on zkSync Era inherits core protocol features while leveraging ZK-rollup technology. The architecture maintains Ethereum security guarantees while reducing transaction costs by over 90%.

zkSync Era uses ZK-SNARK proofs to validate transactions off-chain. Batches compress into cryptographic proofs posted to Ethereum. Transaction finality occurs within seconds. The October 2025 Atlas upgrade improved performance to 15,000+ TPS with one-second finality.

Data: zkSync Documentation, L2Beat, Gas Price Trackers (October 2025)

The deployment maintains Aave's standard contract structure. Users interact with lending pools through familiar interfaces. Smart contracts handle collateral management, liquidations, and interest calculations automatically.

Chainlink provides decentralized price feeds for supported assets. Oracle updates occur at regular intervals or when price deviations exceed thresholds. This ensures accurate collateral valuations and prevents manipulation.

Flash loans remain available on zkSync deployment. Developers can borrow assets without collateral within single transaction block. This enables arbitrage, collateral swapping, and other advanced DeFi strategies with near-zero cost compared to Ethereum mainnet.

Supply caps limit maximum deposits per asset. This risk management feature prevents overexposure to any single token. Borrow caps similarly restrict total borrowing amounts. Chaos Labs provides ongoing risk parameter recommendations based on market conditions.

Asset Performance and Interest Rates

Four assets launched on Aave V3 zkSync Era deployment. Interest rates fluctuate based on supply and demand dynamics.

| Asset | Typical Supply APY | Typical Borrow APY | Max LTV | Liquidation Threshold | Primary Use Case |

|---|---|---|---|---|---|

| USDC | 2-7% | 4-12% | 80% | 85% | Stable yield generation |

| USDT | 2-6% | 4-11% | 75% | 80% | Alternative stablecoin |

| WETH | 1-4% | 3-8% | 82% | 85% | ETH holder leverage |

| wstETH | 1-3% | 3-7% | 71% | 76% | Liquid staking derivative |

Data: Aave Protocol Interface, Historical Rate Analysis (November 2025)

Interest rates adjust dynamically through algorithmic model. When utilization increases, borrow rates rise to incentivize deposits. This maintains protocol liquidity across market conditions.

Stablecoins offer predictable yields between 2-7% APY for suppliers. During high-demand periods, rates can spike above 10%. These assets see consistent borrowing activity for leverage and working capital needs.

WETH serves as primary collateral. ETH holders can borrow stablecoins against positions without selling. The 82% loan-to-value ratio allows borrowing up to $820 for every $1,000 in collateral.

wstETH enables double earning potential. Users earn staking rewards from Lido while using tokens as collateral. The lower 71% LTV reflects additional risk from liquid staking derivative structure.

Variable rates dominate borrowing activity. These rates fluctuate continuously with utilization but typically remain lower than stable rates. Stable rate borrowing offers predictability but costs 20-50% more on average.

Reserve factors allocate 10-20% of interest to Aave DAO treasury. This funds protocol development and security measures. Suppliers receive remaining 80-90% proportional to pool share.

zkSync Atlas Upgrade October 2025

zkSync launched Atlas upgrade in late October 2025, transforming the network's capabilities. The upgrade introduced unified liquidity architecture eliminating fragmented pools across Layer 2 platforms.

Atlas enables direct access to Ethereum mainnet liquidity. zkSync chains now settle transactions instantly with minimized slippage. This solves persistent duplication of liquidity infrastructure on L2 networks according to Coinfomania analysis.

The upgrade achieves over 15,000 transactions per second with one-second finality and near-zero transaction fees. These specifications make zkSync competitive for high-frequency DeFi trading, institutional settlements, and real-world asset integration.

Vitalik Buterin publicly endorsed Atlas on October 27, 2025, describing the initiative as "overlooked and significant" with transformative potential for Ethereum ecosystem. This endorsement amplified technical achievements and drew developer interest.

Over 30 institutions expressed interest following Atlas launch, including Citibank according to Bitget News. The unified liquidity framework enables real-time settlements attractive for traditional finance integration.

However, adoption metrics remain modest. Daily active addresses reached 10,400 on October 27, reflecting 26% increase over previous month. TVL in zkSync DeFi protocols stays in tens of millions, trailing competitors like Arbitrum and Optimism.

ZK token performance improved post-Atlas. 24-hour trading volume surged past $700 million, a 30x increase. The token's redesign shifted focus from governance to value capture through buybacks and staking rewards.

For Aave deployment, Atlas provides technical foundation for improved performance. However, sustainable liquidity growth depends on continued protocol development and user onboarding beyond temporary incentive programs.

Security and Risk Management

Aave protocol maintains robust security practices across all deployments. zkSync Era implementation follows established standards.

The protocol underwent audits from multiple firms including OpenZeppelin and Peckshield. All audit reports are publicly available on GitHub. No critical vulnerabilities remain unfixed according to latest assessments from November 2025.

Bug bounty program through Immunefi offers rewards up to $1 million for critical smart contract vulnerabilities. High-severity findings receive up to $75,000. Over 100 security researchers participate actively.

Safety Module holds $246 million backstop for protocol insolvency as of security documentation. AAVE token stakers provide this insurance layer. They earn 5-7% APY plus additional rewards. Staked tokens can be slashed up to 30% during shortfall events.

Risk parameters receive continuous monitoring. Chaos Labs analyzes market conditions and recommends adjustments. Supply caps prevent excessive exposure to volatile assets. Liquidation thresholds maintain healthy collateralization ratios.

| Risk Type | Mitigation Strategy | Current Status | Last Assessment |

|---|---|---|---|

| Smart Contract | Multiple audits, bug bounties, formal verification | No critical issues | Ongoing |

| Oracle Failure | Chainlink decentralized feeds, multiple data sources | Operating normally | Real-time |

| Liquidation Risk | Conservative LTV ratios, 10% liquidation penalty | Functioning properly | Per block |

| Network Issues | zkSync scalability, Atlas upgrade improvements | Low congestion | Real-time |

| Bridge Security | Time delays, multi-sig controls, zkProof validation | No incidents | 24/7 |

Data: Aave Security Documentation, Chaos Labs, Immunefi (November 2025)

The August 2024 compiler bug highlighted proactive security culture. Matter Labs discovered the issue during final testing before exposing user funds. Updated compilers resolved the problem within weeks.

No major security incidents affected Aave on zkSync since launch. The protocol maintains clean track record compared to other DeFi platforms. Industry data shows 40% decrease in DeFi exploits during 2024, reflecting improved security practices sector-wide.

However, risks remain inherent to DeFi. Smart contracts contain complexity that audits may not catch. Oracle manipulation could affect price feeds. Network-level issues on zkSync or Ethereum could impact operations. Users should understand these risks before participating.

Aave V4 Upgrade Q4 2025

Aave V4 represents the next protocol evolution. Release is scheduled for Q4 2025 with several improvements.

Hub and Spoke architecture replaces current design. Liquidity hubs act as central pools connected to specialized lending markets (spokes). Each spoke operates with distinct risk profiles and interest rates. This eliminates liquidity fragmentation across markets.

Fuzzy-controlled interest rates automate adjustments based on market conditions. Chainlink develops data feeds to optimize capital efficiency. Rates respond faster to supply and demand changes.

Reinvestment Module deploys idle pool capital into low-risk yield strategies. This increases efficiency for liquidity providers without compromising security. The feature emerged as late addition to original V4 design according to founder Stani Kulechov.

Position Manager automates complex DeFi strategies. Users define rules for borrowing, repayments, and withdrawals. Smart contracts execute actions automatically when conditions trigger.

Multi-call batch feature combines multiple operations into single transactions. Users save gas fees and reduce execution complexity. Deposit collateral and open borrow position in one action.

Health-targeted liquidation system improves upon current mechanisms. Liquidations execute more efficiently during market volatility. Borrowers receive better treatment during repayment difficulties.

Gas fee reductions reach 30-50% through technical innovations. Optimized smart contract architecture reduces computational requirements.

The upgrade will affect all Aave deployments including zkSync. However, timeline for specific network implementations remains unconfirmed. Governance votes will determine rollout priorities.

Future Outlook and Challenges

Several factors shape Aave's trajectory on zkSync. The protocol faces both opportunities and adoption hurdles.

zkSync Atlas upgrade provides technical foundation for growth. Unified liquidity architecture and institutional interest create potential. However, converting interest into sustained TVL growth remains challenge.

DeFi adoption on zkSync stays in early stages. Daily active addresses reached 10,400 in October 2025. This represents growth but trails other Layer 2 solutions. Protocols must attract users beyond incentive programs.

Competition from native zkSync protocols intensifies. ZeroLend offers gasless transactions and account abstraction features. Aave must balance proven reliability with innovation to maintain competitive position.

Real World Asset integration represents growth opportunity. Tokenized securities, real estate, and commodities could unlock trillions in collateral. Regulatory clarity will determine adoption speed.

Institutional adoption increases gradually. Aave Horizon serves enterprise clients with permissioned markets. Combined with zkSync privacy features, this appeals to traditional finance players.

GHO stablecoin expansion continues. Aave's native stablecoin launched on Ethereum aims for multi-chain presence. zkSync deployment could increase utility and circulation.

Cross-chain liquidity becomes more important. Aave operates on 18 networks currently. Unified liquidity layers could improve capital efficiency. V4 architecture supports this vision through Hub and Spoke model.

Regulatory environment evolves globally. Clear frameworks could accelerate institutional adoption. Restrictive regulations might limit certain features or jurisdictions.

FAQ

Sources

Protocol Data and Analytics:

DefiLlama - Aave Protocol TVL and zkSync Era metrics (November 2025)

The Block - Aave's parabolic rise analysis and institutional embrace

Aavescan - Historical lending rates and market statistics

zkSync Atlas Upgrade:

Bitget News - Vitalik Buterin endorsement and institutional adoption

Coinfomania - Atlas upgrade technical specifications

CryptoFront News - Performance metrics and DeFi growth analysis

Official Documentation:

Aave Governance Forums - zkSync deployment proposals

Aave Security Documentation - Audit reports and risk management

zkSync Documentation - Technical architecture and performance data

Market Analysis:

BeInCrypto - Multichain lending platforms comparison (January 2025)

NFTgators - zkSync Ignite Program TVL analysis

ZK Nation Forum - Ignite Program efficiency metrics

Related Resources: