List of Solutions to DAO Voter Apathy in 2025

Why DAO Voter Participation Remains Low

DAO voter turnout averages 17% globally in 2025. This means 83 of every 100 token holders skip governance votes. The problem stems from three root causes: high costs, complexity, and power concentration.

Gas fees on Ethereum mainnet made voting expensive. Small holders paying $5-50 per vote often hold tokens worth less than transaction costs. Proposals spanning 50 pages of technical jargon overwhelm non-technical members. When the top 20% control 78% of voting power, small holders feel votes cannot change outcomes.

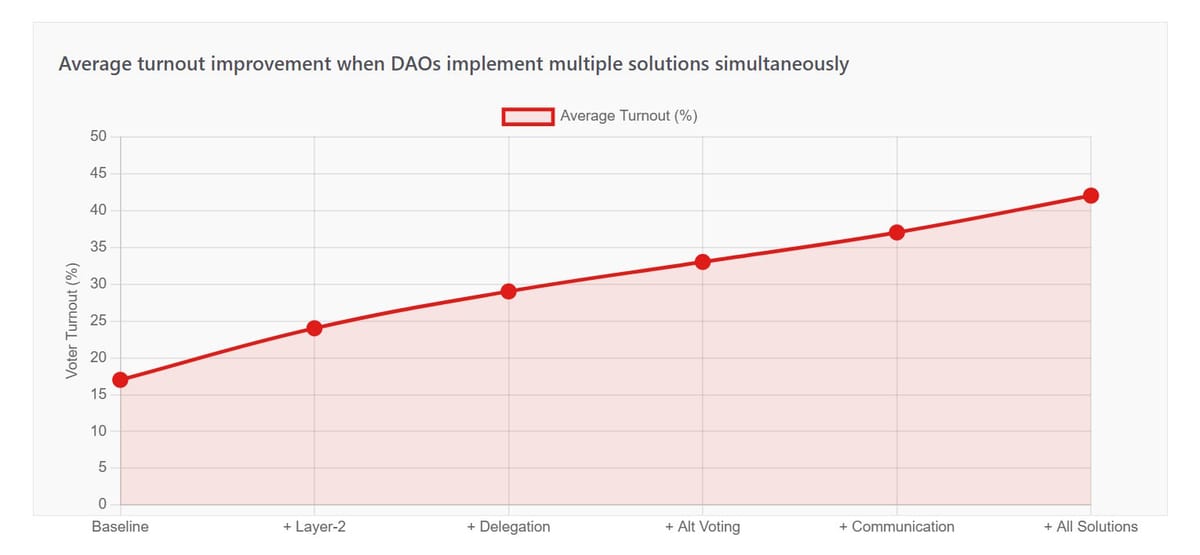

The solutions below address each barrier. Layer-2 networks cut costs by 90%. Simplified interfaces reduce complexity. Alternative voting mechanisms redistribute power. DAOs implementing these changes see turnout gains of 12-30%.

Layer-2 Networks Slash Voting Costs

Moving governance to Layer-2 blockchains removes the biggest economic barrier. Optimism, Arbitrum, and Base reduce gas fees from $5-50 to $0.05-0.50 per vote. This 90% cost reduction makes frequent participation affordable for average users.

The impact shows in the data. DAOs that migrated to Layer-2 in 2025 report 8-15% higher turnout. Voters who previously saved their participation for major proposals now engage with routine decisions. The economic friction disappears.

Implementation requires technical migration but major protocols provide clear paths. Snapshot offers gasless off-chain voting that costs nothing. Over 12,500 DAOs use Snapshot for initial signaling before executing final decisions on-chain. This two-step process balances cost savings with security.

For DAOs committed to full on-chain governance, Tally and Aragon support Layer-2 deployments. These platforms handle the technical complexity while maintaining transparent, auditable voting records. The transition typically takes 2-4 weeks depending on treasury size and contract complexity.

| Platform | Voting Cost | Active DAOs 2025 | Setup Time | Best For |

|---|---|---|---|---|

| Snapshot (Off-chain) | $0 | 12,500+ | 1-2 days | Signaling, temperature checks |

| Tally (L2) | $0.05-0.50 | 2,100+ | 2-3 weeks | On-chain execution, analytics |

| Aragon (L2) | $0.10-1.00 | 3,000+ | 1-2 weeks | Customizable frameworks |

| DAOhaus (L2) | $0.05-0.75 | 850+ | 3-5 days | No-code setup |

Data: Alchemy, Sablier, PatentPC

Delegation Systems Let Experts Vote

Liquid democracy solves the expertise problem. Token holders delegate voting power to trusted representatives who vote on their behalf. This lets busy or non-technical members participate through proxies while maintaining the option to revoke delegation anytime.

Compound, Uniswap, and ENS all expanded delegation features in 2025. Tally and Agora make the process simple. A user selects a delegate through the interface, and their tokens automatically count toward that delegate's voting weight. No technical knowledge required.

The results prove the model works. MakerDAO delegates control 9.16% of voting power individually through delegation systems. This creates accountability without requiring every token holder to analyze complex technical proposals about interest rates and collateral ratios.

Optimism pioneered a two-house system that separates capital from participation. The Token House uses standard token voting. The Citizens' House grants voting rights through non-transferable NFTs based on contribution history. This dual structure prevents pure plutocracy while maintaining token holder influence.

Arbitrum formed specialized councils for urgent decisions. The Security Council can patch vulnerabilities within hours rather than waiting days for full DAO votes. The Grants Council handles funding applications. This delegation to smaller expert groups speeds decision-making without centralizing all power.

Data: Frontiers in Blockchain, ArXiv

Quadratic Voting Reduces Whale Dominance

Quadratic voting fixes the power concentration problem through exponential cost scaling. One token equals one vote. Four tokens equal two votes. Nine tokens equal three votes. The square root calculation prevents any single holder from overwhelming collective will.

Adoption grew 30% in 2025. Over 100 DAOs now use quadratic voting, including Gitcoin and multiple Optimism-based projects. The mechanism maintains whale influence without letting them dominate. A holder with 10,000 tokens gets 100 votes instead of 10,000.

Implementation works through specialized contracts that calculate vote weights automatically. Snapshot supports quadratic voting natively. Aragon offers it as a plugin. The technical lift is minimal compared to the governance benefits.

The tradeoff is complexity. New members need education about why their vote counts differ from token holdings. Clear documentation and examples help. Most DAOs that adopt quadratic voting report initial confusion followed by acceptance once members see fairer outcomes.

Comparison of Voting Power Distribution

| Token Holdings | Standard Voting Power | Quadratic Voting Power | Power Reduction |

|---|---|---|---|

| 100 tokens | 100 votes | 10 votes | 90% |

| 1,000 tokens | 1,000 votes | 31.6 votes | 96.8% |

| 10,000 tokens | 10,000 votes | 100 votes | 99% |

| 100,000 tokens | 100,000 votes | 316 votes | 99.7% |

Mathematical calculation based on square root formula

Soulbound Tokens Tie Rights to Participation

Soulbound tokens represent the most radical departure from token-based voting. These non-transferable NFTs cannot be bought or sold. Instead, DAOs issue them based on contribution history, attendance, or other participation metrics.

Over 200 DAOs adopted decentralized identity systems using soulbound tokens in 2025. The approach prevents vote buying and Sybil attacks where one actor creates multiple wallets. Each verified identity gets one token regardless of wealth.

Optimism's Citizens' House demonstrates the model at scale. Members receive soulbound NFTs after demonstrating commitment through contributions. These tokens grant equal voting power on public goods funding decisions. The result is more democratic outcomes than pure token voting.

ApeCoin DAO uses a hybrid approach. The ApeAssembly requires forum participation or minimum holdings to join. This filters out passive speculators while allowing both engagement and investment as paths to membership.

Implementation requires identity verification infrastructure. Platforms like Otterspace and Gateway specialize in credential-based governance. They verify users through on-chain activity history, social connections, or external credentials like GitHub contributions.

Reputation Systems Reward Active Contributors

Reputation-based governance allocates voting rights through meritocracy rather than plutocracy. Members earn voting power by completing tasks, providing feedback, and contributing to the DAO's mission. Financial investment becomes optional.

Colony and Coordinape lead this approach. Users build reputation through peer reviews and completed bounties. The accumulated reputation translates to voting weight on proposals. This creates natural alignment between decision-makers and those doing the work.

The model works especially well for service DAOs and creator communities where contribution matters more than capital. A developer who commits code weekly earns more influence than a passive token holder. This matches authority with expertise.

SourceCred provides the infrastructure for tracking contributions across GitHub, Discord, and other platforms. The system automatically awards reputation points based on activity. DAOs can customize which actions earn points and how much weight each action carries.

The downside is measurement difficulty. Not all contributions are easily quantified. Subjective work like design or strategy requires human judgment. Most successful reputation systems combine automated tracking with periodic peer reviews to capture qualitative value.

Gamification Makes Participation Rewarding

Turning governance into a game increases engagement without requiring direct payment. Aavegotchi proves the model works. Voters earn XP for their NFTs when proposals reach quorum. These points upgrade rarity traits, creating collectible value beyond governance rights.

The approach works because it taps into intrinsic motivation. Players pursue XP in games without expectation of financial return. Applying the same psychology to governance transforms voting from a chore into an achievement.

Other gamification techniques include: voting streaks that unlock badges, leaderboards showing most active voters, achievement systems for participation milestones, and visual progress bars tracking community engagement toward goals.

The key is making the game elements meaningful rather than superficial. Aavegotchi's XP system works because rarity affects NFT market value and game mechanics. Generic badges that grant no benefits see lower engagement.

Data: CoinLaw, DeepDAO

Financial Incentives Raise Turnout Modestly

Direct payment for votes produces mixed results. Pilot DAOs that introduced financial incentives in 2025 raised average turnout by 12%, according to CoinLaw. That brought participation from 17% to 19%. The gain is real but modest.

The limitation is sustainability. Mercenary voters arrive when payments start and leave when they stop. The DAO must maintain incentive budgets indefinitely or risk participation collapse.

Performance-based systems work better. Sasha Ivanov from Waves recommends tying rewards to engagement KPIs rather than simple vote casting. Voters who miss three straight proposals lose voting power. This creates accountability without requiring continuous payment.

David Kemmerer from CoinLedger argues that token utility matters more than direct incentives. When governance tokens also grant protocol fee discounts or staking rewards, holders have multiple reasons to stay engaged. The voting right becomes one benefit among several.

The evidence suggests incentives work best as a supplement rather than primary driver. DAOs should focus on meaningful governance, clear communication, and accessible interfaces first. Incentives can then boost already functional systems.

Communication Improvements Lower Barriers

Complexity kills participation. Proposals spanning 50 pages with technical jargon exclude most token holders. The solution is multi-format communication that meets voters at different knowledge levels.

Compound DAO provides visual one-pagers, podcast episodes, and "Explain Like I'm 5" summaries for every proposal. This lets busy members grasp key points in minutes. Technical details remain available for those who want depth. Turnout stays above 19% as a result.

Notification systems evolved beyond simple Discord posts. Push notifications, SMS alerts, and email reminders keep governance visible. Reminders arrive three days before voting, one day before, and on the voting day. This treats proposals as important events rather than background noise.

Proposal templates standardize formats across DAOs. Sections for motivation, benefits, risks, and costs help voters evaluate options quickly. Aragon DAOs using structured templates see 15% higher turnout than those with freeform proposals.

Mobile optimization matters. Over 60% of crypto users check portfolios on phones. DAOs that launched mobile-optimized voting in 2025 saw turnout gains of 8-12%. The interface must work on small screens without requiring desktop access.

AI Tools Analyze Proposals Automatically

Artificial intelligence entered DAO governance in 2025 to address information overload. AI-powered tools now analyze proposals, predict outcomes, and flag potential issues. This helps voters make informed decisions without reading dozens of pages.

Predictive analytics forecast proposal effects using historical data. When a treasury proposal suggests reallocating 30% of funds to a new strategy, AI models can show how similar moves performed in the past. This data-driven approach reduces debate time.

Sentiment analysis scans forum discussions and social media to gauge community feeling before formal votes. Proposal authors get early feedback and can refine ideas before submission. This reduces failed votes that waste time.

Treasury management saw the biggest AI gains. Automated systems audit finances, flag unusual transactions, and optimize asset allocation. This frees human governance for strategic decisions while AI handles operational monitoring.

The technology remains controversial. Some community members worry that AI-generated summaries miss nuance or introduce bias. Best practices suggest using AI as a tool for understanding rather than decision-making. Humans retain final authority.

Multi-Signature Wallets Prevent Single Points of Failure

Governance attacks cost DAOs over $90 million in 2025. Multi-signature wallets provide essential protection by requiring multiple approvals for treasury transactions. A 3-of-5 multisig means three designated members must sign before funds move.

Time-locks add another security layer. Proposals that pass votes face mandatory waiting periods before execution. This gives communities windows to detect and challenge suspicious activity. Compound uses a 2-day time-lock on all governance changes.

The security benefit is clear. Flash loan attacks where attackers borrow tokens, vote, drain treasuries, and repay loans within minutes become impossible. The time-lock forces the attack to span days, making detection likely.

Gnosis Safe leads multisig implementation with support for multiple chains and integration with major governance platforms. Setup takes 30 minutes. DAOs typically use 3-of-5 or 5-of-9 configurations depending on size.

Proven Implementation Strategies

Successful DAOs combine multiple solutions rather than relying on single fixes. The most effective strategy in 2025 involves four components: low-cost voting via Layer-2 or Snapshot, delegation systems for expertise, alternative voting mechanisms to reduce power concentration, and clear communication through templates and summaries.

Start with infrastructure. Migrate to Layer-2 or implement gasless voting first. This removes the economic barrier immediately. Tally and Aragon provide migration guides. Budget 2-4 weeks for technical work.

Add delegation next. This solves expertise gaps without requiring every member to become a protocol expert. Clearly document delegate responsibilities and provide dashboards showing their voting records. Transparency builds trust.

Test alternative voting mechanisms on non-critical proposals. Use quadratic voting or reputation systems for grants or minor treasury allocations. Gather feedback before applying them to major decisions. This gradual approach reduces resistance.

Invest in communication. Hire technical writers to create proposal summaries. Record podcast explanations. Build Discord bots that send vote reminders. These operational improvements matter as much as technical changes.

Measure results monthly. Track turnout rates, proposal success rates, and feedback from members. Adjust based on data. DAOs that treat governance as a product with continuous improvement see steady gains.

Data: CoinLaw, Kaliham, OKX

Frequently Asked Questions

Key Resources

Explore the comprehensive DAO tools database to find platforms and services for implementing these solutions. For DAOs to study and join, review the complete list of active DAOs with detailed governance information.

Sources

CoinLaw: Decentralized Autonomous Organizations Statistics 2025

Kaliham: The Ultimate Guide to DAO Governance Models and Voting Systems

Frontiers in Blockchain: Decentralizing governance: exploring the dynamics and challenges of digital commons and DAOs

OKX: Governance in Blockchain DAOs, Revolutionizing DAO Governance

ArXiv: Delegation and Participation in Decentralized Governance

PatentPC: DAO Growth Stats: Treasury Sizes, Governance Votes & Activity

Sablier: DAO Governance Voting Tools: The Ultimate Guide

CoinGecko: What Are Soulbound Tokens and How They Shape Digital Identity