6 Interesting DAO Insights from 2022

Despite the general crypto winter, 2022 was a big year for decentralized autonomous organizations (DAOs). Notably, there was an impressive growth in the number of DAOs over the past year. With 2022 behind us, here are some interesting stats from the year.

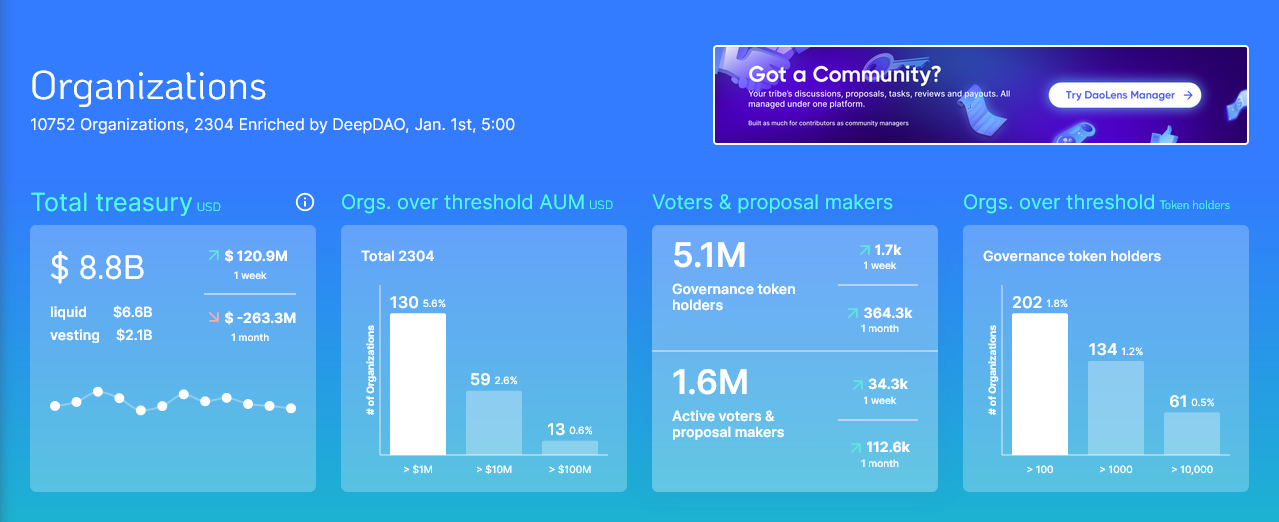

1. Total market capitalization of DAOs is $8.8 billion

As of January 1, 2023, the total market capitalization of the DAO market stood at approximately $8.8 billion. Although it appears the sector is succumbing to the lower prices and bearish sentiment in the general crypto market, the total number of decentralized organizations stood at an impressive 10,752, up from 4,830 organizations just three months ago.

Comparatively, deepdao.io metrics recorded by archive.org indicate there were 4,227 organizations at the beginning of 2022, with a collective treasury of $9.1 billion. At the time, Bitdao commanded the largest share of the market, holding $2.4 billion in its treasury. Uniswap was the second largest, with $2.1 billion. While both DAOs are still the two largest in terms of treasury size, Uniswap is now top on the list.

Meanwhile, data from DeepDAO suggests that $6.6 billion out of the current total DAO treasury is liquid, leaving $2.1 billion vested.

2. Over 50% of the treasury is controlled by the top five DAOs

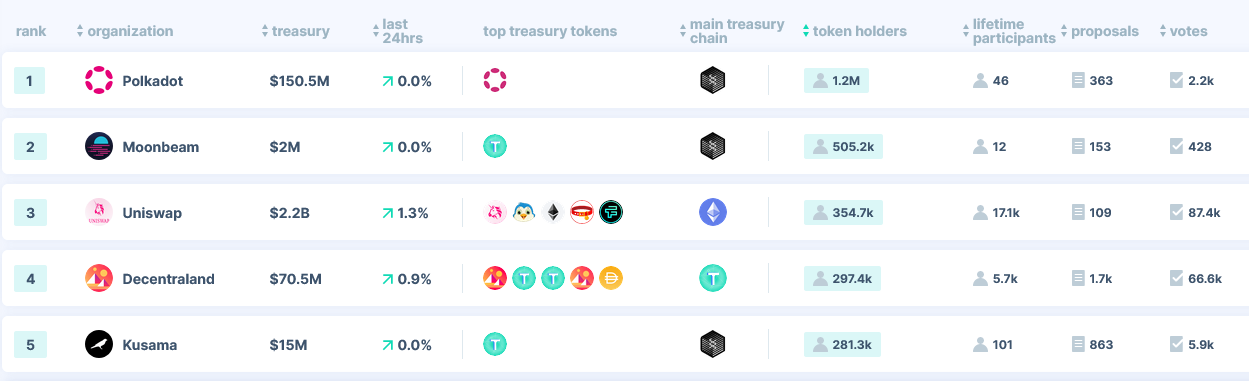

Uniswap currently has the largest treasury size of $2.2 billion, with others like BitDAO, ENS, Gnosis, and Wonderland following behind. Collectively, these five DAOs have a market cap of $5.55 billion or ~63% of the total market cap.

Of the over 2,000 DAOs tracked by DeepDAO, only thirteen have a treasury of over $100 million. This represents 0.6% of the total market. Around 59 DAOs had an asset under management of more than $10 million, and 130 organizations had a treasury of over $1 million.

3. There are over a million active voters in the DAO ecosystem

Holding the native token of a DAO is like being a shareholder in a company. It gives you the right to create proposals and vote on proposals. As of January 2022, there were nearly 497.8k active voters out of a total of 1.7M governance token holders. By the end of the year, the number of governance token holders had surged to around 5.1M, with an estimated 1.6M active voters and proposal makers. DeepDAO’s data board shows that the total number of governance token holders grew by over 350k between November and December 2022.

Surprisingly, sharded multi-chain protocol Polkadot had the highest number of governance token holders at 1.2M, followed by Moonbean at 500k, and Uniswap at 354k. However, in terms of lifetime participants, the DAO of Ethereum Name Service (ENS) had the highest number of participants at 87.2k.

4. DAOs prefer holding native tokens

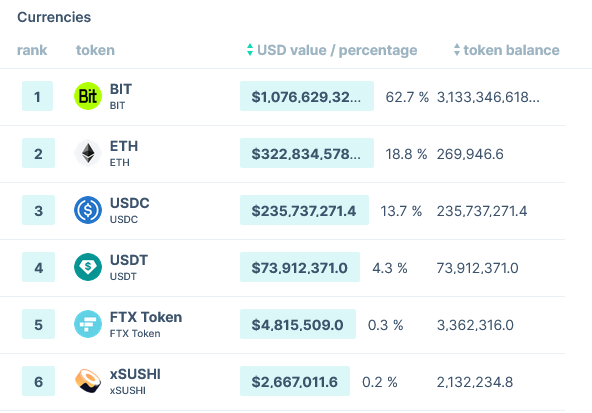

While you may have thought that most DAOs would hold a significant percentage of their treasury in stablecoins (given the highly volatile market), most DAOs preferred to hold their native tokens over non-native tokens. For instance, approximately 100% of Uniswap’s treasury was held in its native UNI token. Similarly, 62.7% of BitDAO’s treasury is being held in its native BIT token. The remaining amount is spread across ETH (18.8%), USDC (13.7%), and USDT (4.3%).

The bottom line is that DAOs have failed to diversify in terms of their underlying assets and this has undoubtedly contributed to the drop in the value of the total market capitalization.

Out of the top 10 DAOs by market cap, about 50% held more than 90% of their treasury in native tokens.

5. Ethereum is the most popular blockchain for DAOs

Despite the attempts of several so-called “Ethereum Killers” to unseat the legacy blockchain, Ethereum has remained the most used Layer 1 network for DAOs.

Of the top 100 decentralized organizations by market cap, a whopping 85 are primarily linked to the Ethereum blockchain. This can be attributed to the massive strength of the network as the second-largest cryptocurrency by market cap and its efforts at pioneering the use of smart contracts.

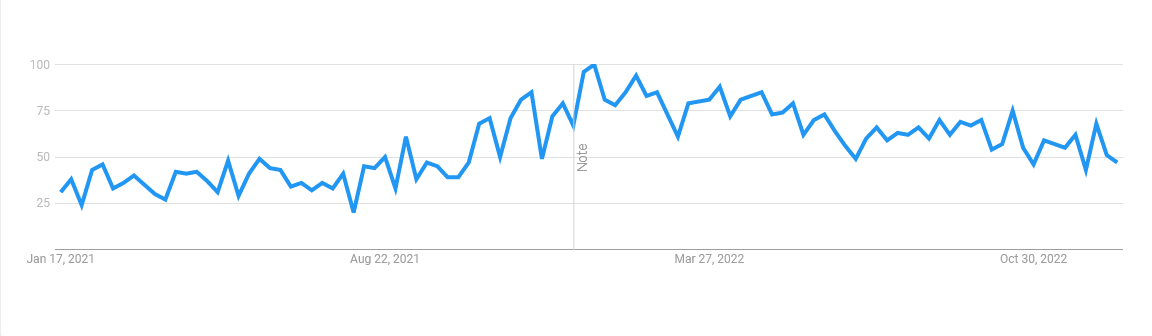

6. DAO market sentiments have remained neutral

The social sentiment for DAOs peaked in January 2022 and has been on a steady decline since then. According to Google Trends, interest in the topic ‘DAOs’ saw a first major drop in March before rebounding in April. In the last weeks of December, interest dropped from 68 to 51, closing the year at 47. For the most part of the year, the interest level was between 50 and 75.